Credlix

Extra Info

Title: Global Supply Chain Finance Company in India | Innovative Solution

URL Source: http://credlix.com/

Markdown Content:

Global Supply Chain Finance Company in India | Innovative Solution

===============

Apply for instant GST business loan upto INR 1 CrCheck Eligibility Now

Financing Solutions

Export factoring Get up to 90% of the invoice value upon shipment

PO Finance Receive quick and hassle-free advances against confirmed purchase orders

Sales Bill Discounting Discount invoices to improve cash flow and help fund future material movement

Early Payment Streamline cash flow and generate higher returns on your funds.

Vendor Finance Empower your suppliers with discounted accounts receivable in just two clicks

Channel Finance Enable financing for your distributors through NBFCs and financial institutions

Business Loan Get unsecured loans without risking your collateral

Tools

HSN Finder Find HSN Code or ITC HS Code for your product

Interest Calculator Calculate Best Pricing For Export Financing

Shipment Calculator Estimate your shipping in seconds

Resources

- Blogs Thoughts, tips & tech talk

- Case Study From challenge to change

- News The latest, all in one place

- Webinars Expert insights, live and direct

- Events From vision to venue

- Videos Streaming knowledge, creativity, and more

- Contact

IND

IND - India

- Mexico

- USA

- Signup

Open main menu

Get immediate Working Capital on upto 95% of the Invoice Value

Domestic Financing  Export Financing

Export Financing

Check Your Buyer’s Creditworthiness Instantly.

Add a buyer and Download their eligibility report

Experience a game-changing approach to supply chain financing with Credlix!

We enable tailored financing solutions powered by cutting-edge tech and an extensive lending network for your business.

Empowering Businesses to Reach New Heights: Factoring, the Superior Alternative to Loans

Factoring provides fast access to working capital by unlocking the value of your unpaid invoices. Unlike loans, it doesn’t add debt. Improve cash flow, seize new opportunities, and grow without waiting for customer payments. It’s smart, flexible, and designed to fuel your business growth.

Get Upto 95% Working Capital Of Your Invoice Value Within 24 Hours

[x] Domestic

[x] Export & Import

Finance Required*

Send OTP

Company Website (Optional)

Get Financed

From Local Roots To Global Expansion

Credlix Empowers MSME Growth

75,000+

Invoice Funded

5000+

MSMEs Onboarded

$500mn+

Disbursed

120+

Cities Coverage

Tailored Capital Solutions for Your Business

Credlix automates financing, letting you focus on what matters most - your business.

40 Cr.Funds upto in 48 Hours

ZeroCollateral needed

Working capital Upto90%of Invoice

ManageMultipleCredit Lines

Hassle FreeProcess

Secure& Reliable

We are backed by global investors

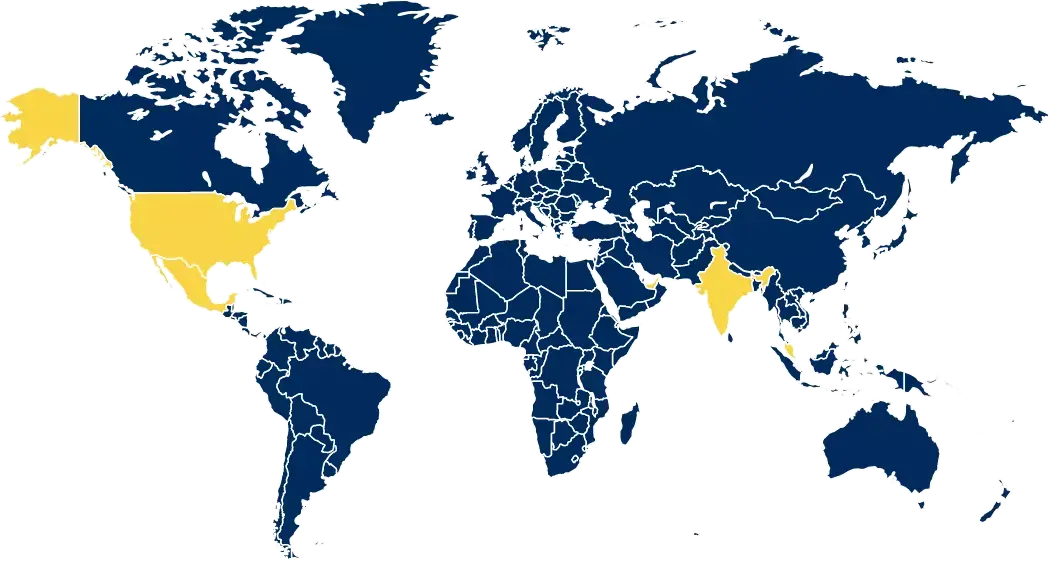

Our Global Network

Enable Faster Results

With offices in India, USA, UAE, and Mexico regions, Credlix offers localized support and expertise to clients worldwide.

India

India Mexico

Mexico Singapore

Singapore USA

USA UAE

UAE

Why Choose Credlix?

Expertise in Supply Chain Financing

As part of the Moglix Group, we leverage deep industry insights and a robust network.

Global Reach

With offices in India, USA, UAE, and Mexico, and partnerships in 90 countries, we support your global trade needs.

Apply Today to unlock the value of your invoices and propel your business growth with Credlix.

Get Financed Now

Credibility You Can Trust

Backed by industry recognition

Our Happy Clients

What they say about us

We significantly improved our suppliers' cash cycle, allowing efficient invoice-to-cash processing

Aditya Birla

Aditya Birla || Fashion & Retail

Know more

Their understanding and knowledge of financing solutions have been valuable for our business.

Deepak Gaur Sharma

MD || Accord

Know more

Manufacturing company automates supply chain financing

Ishita Bowry

Director - Finance ||TwigaFiber

Know more

The entire process of working with the Credlix team has been easy and end-to-end digital.

Ujwal Desai

CEO & Founder || Lucro

Know more

Food processing company adds significant value to its supply chain

Vinod Jobanputra

CEO & Founder || Lalsai Dehy Foods

Know more

Download Our App and Simplify Your Funding Process

Streamline your business fund requirement with our user-friendly app Download now and save time.

FAQs

What is Supply Chain Finance?

Any private or public entity is eligible to avail supply chain finance. Sole proprietorship and partnership companies can also use this facility. Supply chain finance is like a high-tech helper for businesses that makes deals smoother, hassle-free, and more cost-effective. It's a set of smart processes using technology to bring down expenses and make things work better for everyone in a business deal. It’s like a tool that helps buyers and sellers in a transaction save money and do things faster.

What are the Documents Required for Supply Chain Finance?

The documents required for supply chain finance is as follows:

* Identity proof

* Address proof

* Financial documents

* Business ownership documents.

What are the Types of trading services offered under Supply Chain Finance?

The Types of trading services offered under Supply Chain Finance are as follows:

* Invoice Discounting

* Dynamic Discounting

* Supply Chain Financing Platforms

* Receivables Finance

* Payables Financing

* Inventory Financing

* Purchase Order Financing

* Channel Financing

What is the Eligibility Criteria for Supply Chain Finance?

To be able to avail of supply chain financing, the eligibility criteria is as follows:

* Creditworthiness

* Indian Nationality

* Business Vintage of at least 3 years

* Transaction Volume

* Trade Relationship

* Invoices and Receivables

* Supply Chain Visibility

* Compliance

* Financial Health

* A good CIBIL score

What is the Interest Rates for Supply Chain Finance?

There’s no one fixed rate of interest for supply chain finances. It depends on several factors like the provider, companies trustworthiness, creditworthiness, market conditions, and more. The interest rate is mostly competitive in nature.

How can one apply for Supply Chain Finance?

- Step 1: Login to our website https://www.credlix.com/

- Step 2: Give all the necessary information required.

- Step 3: Go through the eligibility criteria thoroughly.

- Step 4: Agree on the financing terms with Credlix.

- Step 5: The final approval.

What are the Features & Benefits of Supply Chain Finance?

Features and benefits of supply chain finance:

* Good working capital and cash flow

* Better inventory management.

* Good returns

* Low cost

* Digital, fast, and safe process

* Up to 90% of invoices financed

* No-collateral is required

Who all can avail Supply Chain Finance?

Any private or public entity is eligible to avail supply chain finance. Sole proprietorship and partnership companies can also use this facility.

What is the repayment tenor of supply chain finance?

The repayment tenor of supply chain finance is 12 months. As per the business requirements, it can also be extended.

What are the types of SME loans for supply chain finance?

The four common types of SME loans for supply chain finance are invoice financing, purchase order financing, supply chain financing, and inventory financing.

How is the interest rate calculated and finalized by the company providing supply chain finance?

The supply chain finance company calculates the interest rate based on how much of the credit limit the client has used up.

How many limits can a business avail from supply chain finance?

A business can receive up to 80% to 85% of the total value of the invoice. It also depends on the specific requirements and eligibility criteria set by the supply chain finance company.

Show More

Keep Up with the Latest on Credlix

<

August 1, 2025 ### Best Loan Options for Exporters Without Collateral Read More

August 1, 2025 ### Best Loan Options for Exporters Without Collateral Read More

July 31, 2025 ### U.S. Imposes 25% Tariffs Accretion: How is it Going to Af... Read More

July 31, 2025 ### U.S. Imposes 25% Tariffs Accretion: How is it Going to Af... Read More

July 30, 2025 ### Restaurant HSN Code Explained: What Food Businesses Need ... Read More

July 30, 2025 ### Restaurant HSN Code Explained: What Food Businesses Need ... Read More

July 29, 2025 ### Accounts Payable Turnover Ratio: Definition, Formula and ... Read More

July 29, 2025 ### Accounts Payable Turnover Ratio: Definition, Formula and ... Read More

July 28, 2025 ### Top 5 Business Loan Providers for MSMEs in India Read More

July 28, 2025 ### Top 5 Business Loan Providers for MSMEs in India Read More

July 25, 2025 ### The Hidden Costs of Delayed Payments in the Food Processi... Read More

July 25, 2025 ### The Hidden Costs of Delayed Payments in the Food Processi... Read More

Early PaymentsSupply Chain Financing

July 24, 2025 ### Export Factoring vs. PO Finance: Which is Right for Your ... Read More

July 24, 2025 ### Export Factoring vs. PO Finance: Which is Right for Your ... Read More

Export FinancingPurchase Order Financing

July 22, 2025 ### Reefer Containers Explained: The Cold Chain Backbone of G... Read More

July 22, 2025 ### Reefer Containers Explained: The Cold Chain Backbone of G... Read More

August 1, 2025 ### Best Loan Options for Exporters Without Collateral Read More

August 1, 2025 ### Best Loan Options for Exporters Without Collateral Read More

July 31, 2025 ### U.S. Imposes 25% Tariffs Accretion: How is it Going to Af... Read More

July 31, 2025 ### U.S. Imposes 25% Tariffs Accretion: How is it Going to Af... Read More

July 30, 2025 ### Restaurant HSN Code Explained: What Food Businesses Need ... Read More

July 30, 2025 ### Restaurant HSN Code Explained: What Food Businesses Need ... Read More

July 29, 2025 ### Accounts Payable Turnover Ratio: Definition, Formula and ... Read More

July 29, 2025 ### Accounts Payable Turnover Ratio: Definition, Formula and ... Read More

July 28, 2025 ### Top 5 Business Loan Providers for MSMEs in India Read More

July 28, 2025 ### Top 5 Business Loan Providers for MSMEs in India Read More

July 25, 2025 ### The Hidden Costs of Delayed Payments in the Food Processi... Read More

July 25, 2025 ### The Hidden Costs of Delayed Payments in the Food Processi... Read More

Early PaymentsSupply Chain Financing

July 24, 2025 ### Export Factoring vs. PO Finance: Which is Right for Your ... Read More

July 24, 2025 ### Export Factoring vs. PO Finance: Which is Right for Your ... Read More

Export FinancingPurchase Order Financing

July 22, 2025 ### Reefer Containers Explained: The Cold Chain Backbone of G... Read More

July 22, 2025 ### Reefer Containers Explained: The Cold Chain Backbone of G... Read More

August 1, 2025 ### Best Loan Options for Exporters Without Collateral Read More

August 1, 2025 ### Best Loan Options for Exporters Without Collateral Read More

July 31, 2025 ### U.S. Imposes 25% Tariffs Accretion: How is it Going to Af... Read More

July 31, 2025 ### U.S. Imposes 25% Tariffs Accretion: How is it Going to Af... Read More

July 30, 2025 ### Restaurant HSN Code Explained: What Food Businesses Need ... Read More

July 30, 2025 ### Restaurant HSN Code Explained: What Food Businesses Need ... Read More

July 29, 2025 ### Accounts Payable Turnover Ratio: Definition, Formula and ... Read More

July 29, 2025 ### Accounts Payable Turnover Ratio: Definition, Formula and ... Read More

July 28, 2025 ### Top 5 Business Loan Providers for MSMEs in India Read More

July 28, 2025 ### Top 5 Business Loan Providers for MSMEs in India Read More

July 25, 2025 ### The Hidden Costs of Delayed Payments in the Food Processi... Read More

July 25, 2025 ### The Hidden Costs of Delayed Payments in the Food Processi... Read More

Early PaymentsSupply Chain Financing

July 24, 2025 ### Export Factoring vs. PO Finance: Which is Right for Your ... Read More

July 24, 2025 ### Export Factoring vs. PO Finance: Which is Right for Your ... Read More

Export FinancingPurchase Order Financing

July 22, 2025 ### Reefer Containers Explained: The Cold Chain Backbone of G... Read More

July 22, 2025 ### Reefer Containers Explained: The Cold Chain Backbone of G... Read More

Get Upto 95% Working Capital Of Your Invoice Value Within 24 Hours

[x] Domestic

[x] Export & Import

Finance Required*

Send OTP

Company Website (Optional)

Get Financed

- An ISO certified company

- Instant approval, quick disbursal

- Minimal documentation, no hard collateral

- 100% visibility, digital dashboards

- FCI Member

Get 95% of your receivables financed within 24 hours

Give us a few details and leverage our supply chain expertise to get a customised approach for your supply chain financing needs.

- Exporters

- Invoice Discounting

- Purchase Order Finance

- Generate Termsheet

- Early Payments

- Vendor Finance

- Interest Calculator

- Compliance

- Credlix Finsights

- Careers

- Resources

- Partnership

- Blogs

Headquarters

Smartworks Corporate Park (Tower B), 1st Floor, Sector 125 Noida,

Uttar Pradesh 201303

India

India

[email protected]

+91-7899343275

United States

[email protected]

+52 8130782189

Business MoglixFabricationEnterprisePackagingDigiMROMoglixTenderSharkMoglix UAE

Popular searches on Credlix

Business Loans

Apply for Business Loan in MumbaiBusiness Loan in AhmedabadBusiness Loan in ChennaiBusiness Loan in KeralaBusiness Loan in BengaluruBusiness Loan for Senior CitizensBusiness Loan for ManufacturersBusiness Loan in DelhiBusiness Loan for Machinery PurchaseBusiness Loan for Construction IndustryBusiness Loan for MSMEBusiness loan for womenBusiness Loan for StartupsBusiness Loan for Agriculture

Financing Solutions

Invoice Financing for BusinessesDomestic and Export FactoringSupply Chain Finance

Trade Tools & Resources

HSN Code FinderFreight Charges HSN Code Lookup

Business Solutions

Working Capital ManagementPO Financing OptionsGST Business Loans

Global Trade Insights

Nearshoring Opportunities in MexicoCross-Border Trade Solutions

Why Credlix?

Tailored Capital SolutionsInstant Approval

Copyright © 2025

Get Financed

Get Upto 95% Working Capital Of Your Invoice Value Within 24 Hours

[x] Domestic

[x] Export & Import

Finance Required*

Send OTP

Company Website (Optional)

Get Financed

Get Upto 95% Working Capital Of Your Invoice Value Within 24 Hours

[x] Domestic

[x] Export & Import

Finance Required*

Send OTP

Company Website (Optional)

Get Financed