Paul Hype Page & Co.

"Paul Hype Page & Co. – Your ASEAN business expansion and compliance partner. Offering only the best one-stop professional services for foreign companies. Designed with people in mind, our end-to-end services deliver your organization's seamless business expansion and compliance experience. With regional expertise of 20 years, Paul Hype Page & Co. is Southeast Asia's leading corporate service provider. We service Singapore, Malaysia, Indonesia, Hong Kong, and more. We are ASEAN CPAs and a Full Practicing Member of the Institute of Certified Public Accountants of Singapore (ICPAS). Our business compliance services include company incorporation with EP, corporate secretary, corporate tax, accounting, auditing services, payroll services, etc."

Extra Info

Title: Business Registration in Singapore | Incorporation Company

URL Source: http://www.paulhypepage.com/

Markdown Content:

Skip to content

- Company Registration

- Relocate with Employment Pass

- MRA Grant

- Business Compliance

- Resources

- Company Registration

- Employment Pass and Migration

- Legal & Company Secretary

- Singapore Taxes

- Accounting, Audit & Payroll

- Run & Expand a Business

- Living in Singapore

Singapore Company Incorporation

With Employment Pass Specialist

Leading Corporate Service Provider. End-to-End Business Solutions and Business Compliance.

Singapore Company Incorporation with Employment Pass | Singapore Business Registration | Post Incorporation Services | Singapore Corporate Compliance.

Homeadmin2024-12-09T09:45:05+08:00

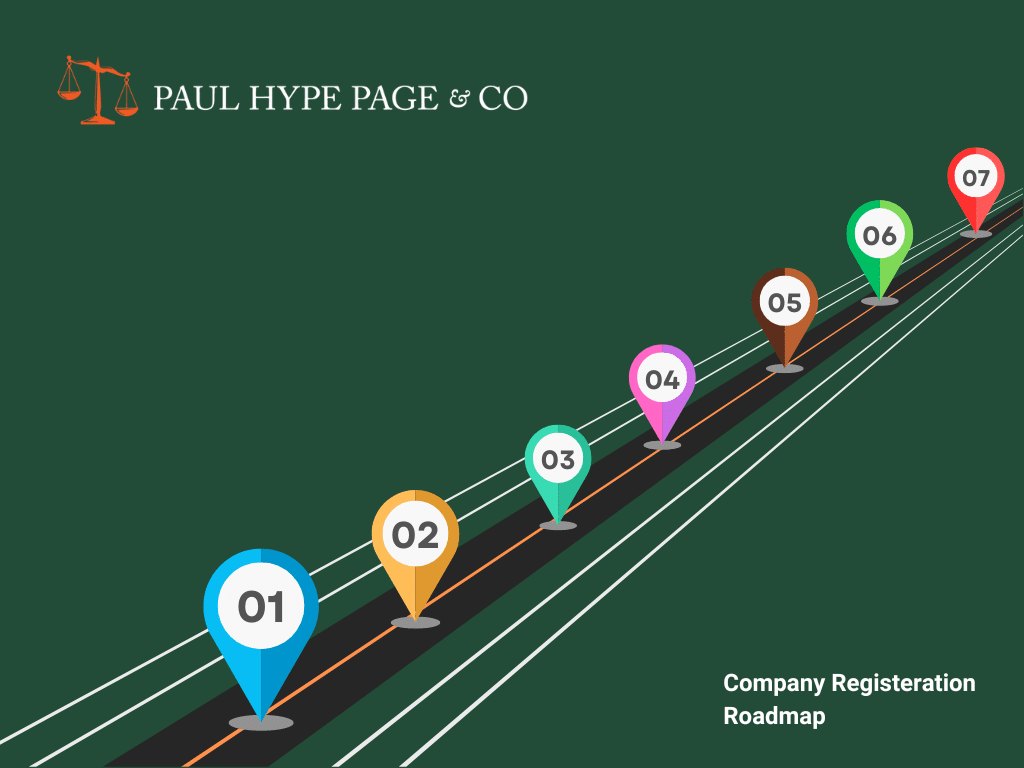

Company Registration Roadmap

Business Success, Everyday.

Your business with our expertise at every stage. We take your services through every phase of your incorporation by supporting you with corporate services.

Find out how Paul Hype Page & Co. will help your company via this roadmap through the incorporation stages and business registration in Singapore

Contact us to incorporate now!

1

Singapore company registration with ACRA

2

Singapore Employment Pass (EP) application for foreigners who are setting up a company in Singapore

3

Corporate bank account opening

4

Corporate secretarial activities such as Annual General Meeting

5

Filing of corporate taxes

6

Accounting, auditing, financial statements & other annual compliance matters

7

Investment migration & asset protection

Benefits of Business Registration

A registered business is more than just a legal entity; it’s a powerful tool for building trust and credibility. Customers, suppliers, and investors alike recognize the value of a registered business. By establishing a formal presence, you signal professionalism, reliability, and a commitment to long-term success.

A registered business opens doors to a world of opportunities. In Singapore, enjoy government grants and subsidies like the MRA Grant to fuel your growth. Plus, partnering with other businesses becomes easier, paving the way for local and global expansion.

By registering your business, you create a legal shield, separating your personal assets from potential business liabilities. This safeguards your personal wealth in the face of unforeseen business challenges or debts.

Kickstart your Singapore Company Registration with a WhatsApp or Request a Quote with our consultant.

All our services are adhered to ACRA regulations.

Trusted Regional Incorporation Partner

Passionate and Dedicated Business Consultants for Success

From startup to scale-up, we’re your trusted partner. Our comprehensive corporate services guide you through every phase of your business journey, ensuring a seamless and successful experience.

20 years

of cumulative experience across Singapore, Malaysia, Indoneisa, and Hong Kong

> 2,000 companies

incorporated across various jurisdictions over the years

93 % success rate

for Singapore Employment Pass application

Trusted Advisors

Network market value positioning imperatives & leveraged

helping your business practically

Why choose Paul Hype Page

Leverage on our expertise for your business solutions, from starting your Singapore company registration to all post-incorporation services.

Our Satisfied Global Clients

See what our clients from around the world have to say about their experiences with us.

Request an Enquiry

Ask us any questions about company registration or employment pass!

Speak to our consultants today to clarify your company incorporation or any corporate services.

Business Hours

Monday to Friday: 9 AM – 6 PM

Expert Guides to Business Success

Gain insiders’ knowledge on our various service pillars from Singapore company registration, Singapore work visas and employment pass, annual compliance to life in Singapore.

Tested. Patented. Proven.

Digital Incorporation Platform

Our unique blend of cutting-edge technology and human expertise ensures you receive exceptional service, wherever you are. With our patented platform and dedicated Relationship Manager, company registration has never been easier or more efficient.

Efficiency and Speed

Our platform streamlines the registration process by automating tasks and providing real-time updates on application status.

Accessibility and Convenience

Our platform offers 24/7 access and an intuitive interface for easy, anytime use.

Security and Reliability

Our platform prioritizes data security and system reliability to ensure a seamless and trustworthy experience.

Contact Info

30 Petain Road Singapore 208099

A company is deemed exempt from audits in Singapore, which means these companies will not need to appoint an auditor to have their accounts audited. However, they need to qualify to be a ‘small’ company based on at least 2 of these 3 criteria:

- Revenue not exceeding SGD 10 million for the financial year.

- Total assets not exceeding SGD 10 million at the end of the financial year.

- Number of employees not exceeding 50.

Despite such small companies are exempt from auditing, they still need to prepare accurate financial statements that comply with the standards in Singapore.

Auditing Practices in Singapore

- Enhances Credibility And Trust

By providing independent assurance of the accuracy and reliability of a company’s financial statements, auditing helps to build credibility and trust with investors, creditors, and other stakeholders. This can lead to increased confidence in the company’s financial position and ultimately support its long-term success. - Improves Financial Management

Auditing provides valuable insights into a company’s financial health, which can help your managers make better decisions and improve financial management practices. This in turn leads to improved efficiency, better use of resources, and ultimately better financial results. - Ensures Compliance With Regulations

Auditing helps to ensure that a company complies with regulatory requirements and industry standards. By ensuring compliance with regulations, your company will be able to avoid legal and financial penalties and operate in a responsible and ethical manner. - Helps Detect And Prevent Fraud

Auditors are trained to identify and investigate fraud and other irregularities, which will definitely help you avoid any fraudulent activities in a company. This is especially important for maintaining the integrity of financial reporting and ensuring that stakeholders have accurate information to make informed decisio

ACRA

ACRA is Singapore’s business regulator. It ensures a trusted business environment by overseeing companies, accountants, and corporate service providers. Its functions include registration, financial reporting, auditing, governance, and disclosure. ACRA’s online platform, BizFile+, simplifies business processes.

IRAS

IRAS is Singapore’s tax authority. It assesses, collects, and refunds taxes. IRAS also educates taxpayers and investigates non-compliance. The MyIRAS portal offers online tax services.

Auditing in Singapore

In essence, ACRA sets the rules, and IRAS enforces them. Both agencies work together to maintain the integrity of financial reporting and ensure that companies are operating within the law. This is essential for investors, lenders, and other stakeholders who rely on accurate financial information.

Paul Hype Page provides you with strategic business expansion and business compliance services for over 2 decades, servicing the best of the South East Asia region. We make your entrepreneurial experience seamless for both locals and foreign expats.

We can issue an IRAS-approved audit report that meets both the Singapore government’s requirements and your company’s needs. The audit function of your company is in good hands with our professional Singapore-certified auditors.

Our audit services in Singapore consist of a vast variety to cater to the specific needs of your organization.

- Annual Financial Audit

- Special Purpose Audit

- Certification for Subsidy Claim

- Audit

- Fixed Assets Certification

- Claim Certification

- Shares Certification

- Personal Income Certification

If you are a foreigner, you will need a nominee director (local director) to incorporate your company in Singapore.

What is a Nominee Director?

Nominee director is an individual who is appointed to act as a director of the company on behalf of another individual or entity. For all foreigners establishing businesses in Singapore, having a nominee director is essential due to regulations from the Accounting & Corporate Regulatory Authority (ACRA).

Here are suitable nominee director services for EP holders in Singapore, allowing the company to transfer ownership to you once your Employment Pass (EP) is approved:

- Short Term Nominee Director (STND) : 2 months and 6 months

If you are a foreigner, you cannot be the director of the company unless you have an Employment Pass also known as an EP. This renewable work visa permits you to live and work in Singapore, whether you’re an employee, business owner, or anything in between.

It’s the most popular choice for foreigners looking to start a business or relocate to Singapore.

First, You will have to incorporate your company under the name of a local Singapore director (Nominee Director). Then, you will have to apply EPass under your company so that we can transfer the ownership to you under your Employment Pass (EP).

The estimated timeline for the Singapore EP application is between 2-4 months, depending on the case. In some instances, it could drag up to 6 months if multiple rounds of appeals are requested.

Singapore Employment Pass, often referred to as the ‘EP,’ a work visa is issued to foreign professionals, managers, executives, and experts relocating to work in Singapore.

You are eligible to apply for EP if you:-

- Have Job Offer from Singapore Company in managerial, executive, and specialized job

- Have at least a fixed minimum salary of S$5,000 per month

- Have recognized diploma or degree from a reputable university

- Have professional qualifications, specialist skills, and work-related experience

- Meet the required minimum of 40 points under the new points-based COMPASS to be eligible for this pass.

Reasons to Apply for a Singapore Employment Pass

- Legally reside and work in Singapore.

- Enjoy hassle-free travel in and out of the country without needing a Singapore entry visa.

- Gain a pathway to potentially obtaining permanent residency in Singapore over time.

- Have the flexibility to run and work for your own business in Singapore.

- Benefit from Singapore’s low tax rates and favorable income tax system.

Are you a business owner in Singapore looking to expand your operations and reach new markets? Considering entry into a new market or expanding an existing one overseas? The MRA grant offers the financial boost you need to make it happen.

The purpose of the MRA grant is to support Singapore owned businesses for business development, promotion, and set-up costs when you set up a business in oversea.

At least 30% of the company’s equity must be held directly or indirectly by Singapore Permanent Residents (PRs) or citizens, determined by ultimate individual ownership.

The grant covers up to 50% of eligible costs for Local SMEs, with specific caps for different activities and limited to a maximum of S$100,000 per new market and may include:

- Overseas Market Promotion (capped at S$20,000)

- Overseas Business Development (capped at S$50,000)

- Overseas Market Set-up (capped at S$30,000)

Currently, from April 1, 2023 to March 31, 2025, the grant covers up to 50% of eligible costs, capped at S$100,000.

If you are planning to set up business in Singapore, opening a corporate bank account is a mandatory when you first incorporate a company. It also allow you to keep your business transactions separate from your personal transactions and also helps you to track your business cash flows/income and expenses.

We focus is to prove that your company has a tax substance and select an account that best fits your business needs. Most importantly, you DO NOT need to be physically here! We work closely with our trusted bankers to give you a higher success rate in opening a corporate bank account.

If you are a foreigner, you will need a nominee director (local director) to incorporate your company in Singapore.

What is a Nominee Director?

Nominee director is an individual who is appointed to act as a director of the company on behalf of another individual or entity. For all foreigners establishing businesses in Singapore, having a nominee director is essential due to regulations from the Accounting & Corporate Regulatory Authority (ACRA).

There are 2 types of Nominee Director services in Singapore.

They are:

- Long term Nominee Director (LTND) : 12 months

- Short Term Nominee Director (STND) : 2 months and 6 months

If you are a foreigner, you cannot be the director of the company unless you have an Employment Pass.

First, You will have to incorporate your company under the name of a local Singapore director (Nominee Director). Then, you will have to apply EPass under your company so that we can transfer the ownership to you under your Employment Pass (EP).

What is Singapore Employment Pass?

Singapore Employment Pass, often referred to as the ‘EP,’ a work visa is issued to foreign professionals, managers, executives, and experts relocating to work in Singapore.

The estimated timeline for the Singapore EP application is between 2-4 months, depending on the case. In some instances, it could drag up to 6 months if multiple rounds of appeals are requested.

Check Your Company Name through ACRA using our free tool!

The requirements for registering a company in Singapore are simple and straightforward. They are:

At least one local resident director

Both Singapore residents and foreigners can serve as directors of a Singapore company, provided there is at least one director who is a Singapore resident.

At least one shareholder

To register a company in Singapore, you need at least one shareholder who can be a person or another company. You can have up to 50 shareholders, and all of them can be foreigners.

Local company secretary

Every Singapore company must have a company secretary who lives in Singapore and is responsible for ensuring the company meets its regulatory requirements and submits necessary filings.

Minimum of $1 Paid up Capital

You can establish your Singapore company with just $1 in paid up capital and share capital. If needed, you can add more funds later and inform the company registrar.

Registered Address in Singapore

Your company needs a registered address in Singapore where all the official documents will be sent to ; a PO box isn’t acceptable.

联系方式

30 Petain Road Singapore 208099